- #TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS PDF#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS MANUAL#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS CODE#

Qualified open-space land includes all appurtenances to the land. “(1) “ Qualified open-space land” means land that is currently devoted principally to agricultural use to the degree of intensity generally accepted in the area and that has been devoted principally to agricultural use or to production of timber or forest products for five of the preceding seven years or land that is used principally as an ecological laboratory by a public or private college or university. The change from 2012 allowing beekeeping is in the last sentence of paragraph (2).

#TEXAS AG EXEMPTION LAND REQUIREMENTS CODE#

The law covering agricultural use related to beekeeping is Texas Tax Code under Chapter 23, Subchapter D, Section 23.52 (1) and (2). What Does the Law Say About Property Tax and Bees?

In that case you would need 6 acres to qualify. Many counties remove an acre for buildings or a homestead. Texas law restricts the property covered by this valuation to between 5 and 20 acres, so you must have at least 5 acres to qualify. How Many Acres Does the Law Allow for Keeping Bees? Our grocery stores produce aisle would look very different without the fruits and vegetables beekeeping makes possible for us. It is claimed that three out of five bites of food we take are dependant on pollinators. ” Pollination is vital to agriculture, and bees are managed pollinators… the only economically viable managed pollinator. Why does the State Offer an Agricultural Tax Break for Beekeeping?Īccording to the State Comptroller’s Office “The aim is for landowners to realize property tax savings to encourage them to continue to produce vital agricultural products, such as livestock, cotton, timber, milk and corn. It might be good for you to use that term when you talk to them, but let’s face it, regular folks just call it ag exempt. When you talk to the appraisal district, they sometimes balk at the word “exemption”. Are we Talking About Ag Exemption or Special Valuation? This post is designed to walk you through the requirements for raising bees for a tax break, minimum and maximum acreage and an estimate of money you could save.

It can be somewhat complex, but there are a few things you need to know to make this easier for you. apply plant food, fertilizer and agricultural chemicals in producing crops or.Understanding all you need to know about beekeeping for agricultural ‘exemption’ is daunting, and getting information from your appraisal district can be a little intimidating.

Timber 400 trees/acre Wildlife Exemption in Texas - Plateau Land & Wildlife Management - Ag Valuation - Texas Beekeeping You can consume it or gift it. There are many options when it comes to providing supplemental food for targeted wildlife. The use of food plots should only be considered as supplement to the native habitat.

#TEXAS AG EXEMPTION LAND REQUIREMENTS MANUAL#

The Manual for the Appraisal of Agricultural Land, Property Tax Division, Comptroller of Public Accounts, April 1990, supports these This includes: Raising stock, poultry, or fish. The rollback tax is due for each of the previous five years in which the land received the lower appraisal.

30.270 Acres, 2463 FM 949 These guidelines will be revised in the future to accommodate changes in law, circumstances or in light of new information. There might be a very rare exception but barns, honey housesand any permanent structure will be appraised at market value. As a farm, in Texas you may be required to file a General Personal Property Rendition form with your appraisal district each year by April 15th. 1768 = $335.13, rounded off to $335 per acre, Making census counts to determine population.

#TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO#

How to Reduce Property Taxes on Open Space Land and Agricultural Land in Texas, Texas Parks and Wildlife (TPWD) Biologist, Land and Ranches for Sale in Colorado County, TX, how much can you save on property taxes in Texas with ag land, how to designate your land as ag use in Texas, how to get ag exemptions on land in texas, how to qualify for wildlife management tax exemptions in Colorado County Texas, how to qualify for wildlife management tax exemptions in Texas, how to qualify land as open space in Texas, how to use bees to qualify for ag exemptions on land in Texas, what is minimum acres required to qualify for ag exemption on property taxes in texas, what is the difference between open space land ag use land in texas, when should you use open space versus ag use in Texas, Five-year average of net to land = $315.92, Gross Productivity Value ($315.92/.1000) = $3,159.20, Maximum hives per Max Acreage = 0.6 x (12hives/20 acres), 20 acres contribution to total bee range = 17.68%, Productivity value $3,159.20 x.

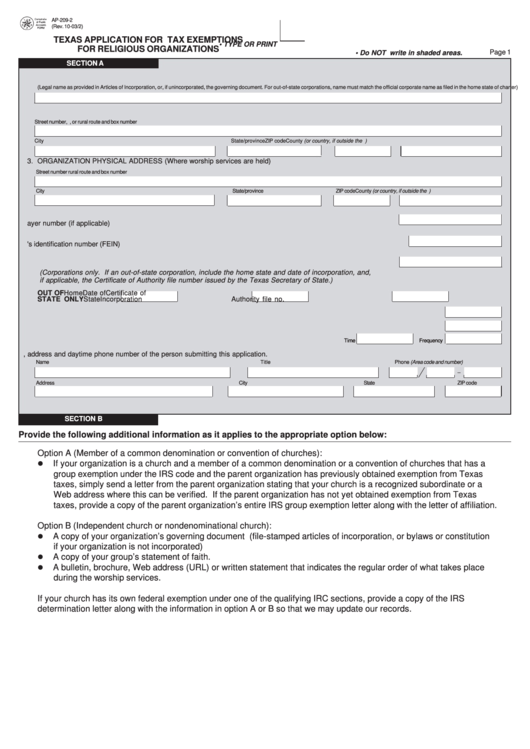

#TEXAS AG EXEMPTION LAND REQUIREMENTS PDF#

The county appraisal district forms and documents that may be downloaded from our website are in Adobe Acrobat Reader PDF format.

0 kommentar(er)

0 kommentar(er)